Topic: For Seniors

Topic: For Seniors

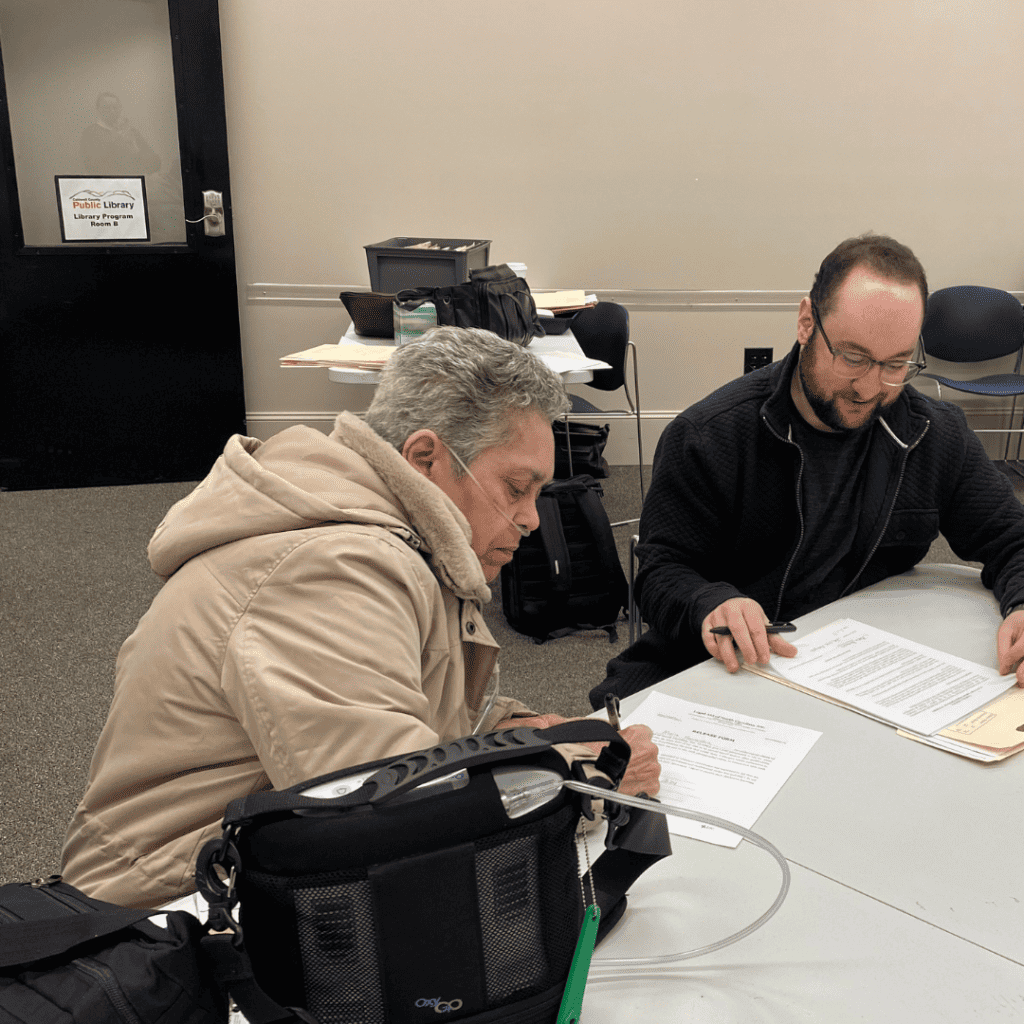

Lenoir, NC – Legal Aid of North Carolina (LANC) recently organized a free wills clinic in Caldwell County, providing legal assistance to seniors in the community. The event, held on March 18th and 19th at the Caldwell County Library, saw 47 seniors receive support from LANC staff and volunteers.

The clinic aimed to address a crucial need among the elderly population by offering guidance and assistance in drafting wills and advanced directives. For many seniors, ensuring their affairs are in order brings a sense of security and peace of mind. By providing these services at no cost, LANC is increasing access to justice and legal resources for vulnerable members of the community.

“I was very pleased and delighted to meet with the LANC attorneys,” said Ms. Hernandez (pictured on the right), a client who received assistance at the clinic. “Everyone was very friendly and made me feel very comfortable during this process. I am grateful that [they] were there to guide me and provide this much-needed service.”

During the two-day event, LANC staff and volunteers provided personalized support to each attendee, ensuring their individual needs and concerns were addressed. From drafting legal documents to providing guidance on estate planning, the clinic offered comprehensive assistance to help seniors navigate complex legal processes.

Staff Attorney Savannah Morgan shared her experience, highlighting the connection formed with seniors throughout the clinic. “It is very fulfilling to be able to serve seniors in this way,” Morgan remarked. “I received so many hugs during the two-day will clinic. It is always great to chat and get to know our clients.”

LANC is committed to serving communities across the state, advocating for the rights and needs of low-income individuals and families. Events like the free wills clinic in Caldwell County highlight the organization’s dedication to providing essential legal services and resources to those who need them most.

###

Legal Aid of North Carolina is a statewide, nonprofit law firm that provides free legal services in civil matters to low-income people to ensure equal access to justice and to remove legal barriers to economic opportunity. Learn more at legalaidnc.org.

Follow us on Facebook, Twitter, Instagram, LinkedIn and YouTube.

Media Contact

Helen Hobson, Chief Communications Officer, 704-430-7616, HelenH2@legalaidnc.org

Topic: For Seniors

Topic: For Seniors

Seniors in need of assistance are encouraged to call our helpline:

Toll-Free: 877-579-7562

Free legal help for North Carolinians 60 years of age or older. Learn more: Senior Law Project

Topic: For Seniors

Anyone who is 18 years of age or older has the right to start a lawsuit in the North Carolina court system. If the lawsuit is for a claim of $10,000 or less (this amount can vary by county), it can be brought into Small Claims Court, which is available in every county. This guide tells you how to fill out the right forms, prepare for trial, handle the trial, and follow through on the judge’s decision.

A Guide to Small Claims Court

Topic: For Seniors

Topic: For Seniors

Most people, when thinking of sexual assault victims, probably don’t think of seniors in nursing homes. Perhaps they should. A CNN investigation found that claims of rape in nursing homes are widespread, but difficult to document and substantiate due to the victims’ circumstances. Many perpetrators of sexual assault seek out victims who are already vulnerable and may have trouble defending themselves or speaking out. This makes seniors in nursing homes especially susceptible, as they depend heavily on others for their most basic and most intimate needs, and may have diminished physical or mental capacity.

Sexual assault of the elderly is difficult to think about, but it’s important to stay aware of possible warning signs in case you ever need to help protect a loved one from such horrific abuse. If you visit someone in a nursing home or know an isolated, home-bound senior who depends heavily on others, pay attention to any sudden changes in behavior or new, unexplained physical injuries.

Trauma from such abuse can manifest in countless ways, including anxiety, depression, loss of appetite, loss of interest in socializing, or fear of talking around certain people. A strained relationship with a caregiver can also be a red flag. (Of course, all of these signs may have other causes.) Keep in mind that talking about sexual assault is difficult for victims of any age, but it may be especially hard for seniors who feel a lack of control over their everyday lives. If you suspect sexual abuse of an elderly person, the best thing to do may be to make sure that they have regular contact with someone they can talk to and confide in safely. You can also tell them about their options for reporting an assault and seeking help.

If a nursing home resident is in immediate danger or has been assaulted recently, they always have the option – and the right – to call 911. When law enforcement gets involved, preserving evidence from a recent assault becomes an important factor to consider. Victims should always be the one to decide whether or not to undergo a forensic exam, but they may need to be made aware that there is a limited time during which evidence can be gathered, e.g., before showering and changing clothes. This can be difficult for nursing homes residents, as facility staff often control their personal care schedules.

Suspected abuse can always be reported to Adult Protective Services (APS) through the senior’s local Department of Social Services. If the victim is not ready to talk to APS, but wants to discuss their options with a liaison, consider contacting a local long-term-care ombudsman at North Carolina’s Area Agencies on Aging. An ombudsman’s sole purpose is to help residents of long-term-care facilities. You can find past complaints against a facility on the federal Medicare website or the Nursing Home Licensure and Certification Section of the North Carolina Division of Health Service Regulation. You can also lodge new complaints with that North Carolina agency.

Another resource for victims is the North Carolina Coalition Against Sexual Assault, a statewide group that coordinates with local rape crises centers, which offer a wide range of supportive services for victims of all ages.

Cases of sexual abuse against seniors can be especially challenging to uncover and prove, but there are special legal protections for elderly victims. While rape and assault against anyone are illegal in North Carolina, state law provides for greater punishment for assaults against disabled or elderly adults, patients of residential health care facilities and handicapped persons. (See North Carolina General Statutes 14-32.1, 14-32.2, 14-32.3)

Topic: For Seniors

Many people don’t realize that the only person who signs a POA, besides a notary, is the individual authorizing someone else to handle their affairs. A valid POA can never be created without the consent of the person whose affairs will be handled by another. Only YOU can give the authority for someone else to handle YOUR affairs under a POA. And that authority may only be given by you voluntarily and at a time when you are mentally competent.

If you’re the one who will sign a POA, it’s important to understand that you may be giving someone broad access to your accounts and property. This means that POAs can too easily be exploited and misused by self-serving people, even if those people are family members. And unfortunately, there are some family members seeking to “get power of attorney over Grandma” who are not well intentioned and who really just want a way to transfer an elderly person’s money or property to themselves. Nobody should ever, under any circumstances, put pressure on you to sign a POA or make decisions for you about the terms of your POA.

If you do sign a POA, it is extremely important to choose wisely the individuals who will handle your affairs. You should choose responsible, dependable people who you have known for a long time and can trust without any misgivings. It also helps to pick someone who is organized, good with details, and already familiar with your financial matters. You have many choices about which financial matters you can authorize that person to handle for you. Standard forms giving broad authority are often used, but those forms may always be tailored to limit the authority given. Ideally, you should consult with an attorney about the type of POA you need and make sure the form reflects exactly what you want. You absolutely have the right to make decisions about your own POA and even to revoke the document if you change your mind about it later (as long as you are still mentally competent).

All of that said, preparing a POA is a great precautionary step to take so that you can make certain choices while you are able to make them and try to avoid problems in the event that you become unable to manage your own affairs. So by all means, get a power of attorney prepared, but take time to weigh your choices first and make sure, before you sign it, that the document reflects your decisions and nobody else’s.

Topic: For Seniors

Everyone can help seniors live life to the fullest by staying safe, healthy and happy.

One important way to help is by empowering seniors to prevent elder abuse – the emotional, physical, sexual or financial victimization of the elderly. Domestic violence has gained increased awareness over the last several decades, but elder abuse remains a problem that is far too prevalent, much too little understood, and, as baby boomers enter their golden years, increasingly important. Without more awareness and recognition of this problem, it’s still too difficult for many seniors to admit when they’ve been physically hurt or taken advantage of financially and to seek help.

Elder abuse takes many forms. It can be a caretaker verbally or physically abusing, or simply neglecting, a disabled family member over whom they have complete control. It can be a scam artist tricking seniors into wiring them money with just a phone call. It can be a trusted person using a power of attorney to steal money from a senior’s bank account. It can be the sexual abuse of a nursing home resident.

Physical and mental limitations can make anyone more vulnerable to abuse, and seniors endure sexual and physical abuse more often than most people realize. Financial exploitation is so common that the North Carolina Department of Justice publishes a 32-page booklet with in-depth descriptions of various scams and fraud targeting seniors.

Preventing elder abuse requires seniors, as well as their families and friends – in other words all of us – to learn more about common scams, signs of abuse to watch out for, and precautions to take with financial and estate planning, including the preparation of advance directives like powers of attorney.

Topic: For Seniors

Becoming dependent on caretakers in a nursing home does require major adjustments and a relinquishment of some control over everyday affairs. Any such heavy dependence on others naturally lends itself to potential abuse or mistreatment when there are not safeguards and protections in place. But under both federal and state law, there are many safeguards and protections that give nursing home residents the right to maintain some autonomy.

Whether you are contemplating admission to a nursing home or just know someone who resides in one, it’s a good idea to become familiar with residents’ rights under both North Carolina and federal law. (Click for summaries of state and federal regulations.) The federal nursing home regulations were recently expanded to give residents more rights.

Both sets of regulations cover privacy and communication, explicitly giving residents the right to have private phone access, mail access and the materials necessary to send and receive mail, as well as the right to have visitors of one’s choice at any reasonable hour. Other important topics addressed in nursing home regulations include choices about scheduling (including waking and sleeping times), when residents must receive notices of changes (including transfers or discharges), how grievances must be handled, and freedom from restraints and abuse.

The state summary of rights lists the right “to manage his/her own financial affairs unless other legal arrangements have been implemented.” It’s important to understand that this does not give agents named in powers of attorney the right to go beyond the authority given in that document or to restrict a resident’s access to visitors or communication with others. I sometimes hear from clients that family members acting under a power of attorney believe they can unilaterally decide which visitors the resident may receive. However, powers of attorney generally do not give agents that authority and nursing homes should not go against the resident’s wishes about visitor access.

One thing that should be considered carefully at the very beginning of a nursing home stay is the admission agreement, typically a lengthy and comprehensive document. As with any contract, it’s important to read this document closely and discuss any questions or concerns before signing it. Some facilities may not yet have updated their contracts to reflect current law. For example, nursing homes have traditionally asked for a cosigner, a third party such as a spouse or other family member, to agree to be financially responsible in these contracts.

However, facilities that accept Medicaid or Medicare are now prohibited by federal law from requesting or requiring such responsibility from a third party. They are also prohibited from requiring a waiver of the facility’s liability for loss of a resident’s personal belongings. Reviewing these agreements carefully before signing them and knowing one’s rights ahead of time can help with transitions into nursing homes so that they don’t have to feel like the beginning of the end.